Exactly How Livestock Threat Defense (LRP) Insurance Can Safeguard Your Livestock Financial Investment

Livestock Danger Security (LRP) insurance coverage stands as a reputable guard against the unforeseeable nature of the market, providing a calculated approach to protecting your possessions. By delving into the ins and outs of LRP insurance policy and its complex advantages, animals manufacturers can strengthen their investments with a layer of safety that transcends market changes.

Comprehending Animals Danger Protection (LRP) Insurance Policy

Comprehending Livestock Threat Defense (LRP) Insurance coverage is essential for livestock producers wanting to reduce economic threats related to rate changes. LRP is a government subsidized insurance coverage item developed to secure manufacturers against a decrease in market prices. By providing coverage for market rate declines, LRP aids producers secure a flooring cost for their livestock, guaranteeing a minimum degree of revenue despite market fluctuations.

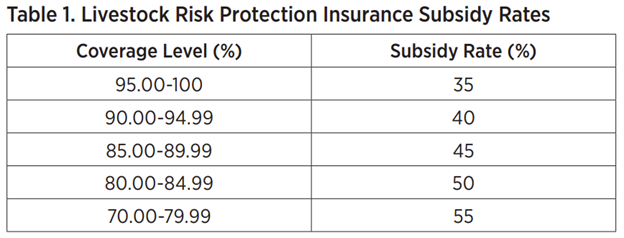

One secret element of LRP is its adaptability, enabling manufacturers to tailor insurance coverage degrees and plan lengths to fit their particular needs. Producers can choose the number of head, weight variety, insurance coverage price, and protection period that line up with their manufacturing goals and run the risk of tolerance. Understanding these customizable choices is important for manufacturers to effectively handle their rate threat direct exposure.

Furthermore, LRP is available for different livestock types, including cattle, swine, and lamb, making it a flexible threat administration tool for livestock producers across different sectors. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, producers can make enlightened decisions to guard their financial investments and make sure monetary security despite market uncertainties

Benefits of LRP Insurance Coverage for Livestock Producers

Animals manufacturers leveraging Animals Threat Protection (LRP) Insurance coverage gain a tactical advantage in shielding their investments from price volatility and safeguarding a steady financial ground amidst market unpredictabilities. One essential advantage of LRP Insurance is cost defense. By setting a flooring on the cost of their animals, manufacturers can minimize the risk of substantial financial losses in the occasion of market slumps. This permits them to plan their budget plans better and make notified choices regarding their procedures without the consistent anxiety of price variations.

Furthermore, LRP Insurance provides manufacturers with satisfaction. Knowing that their financial investments are secured versus unanticipated market changes permits producers to focus on various other elements of their business, such as boosting pet health and well-being or maximizing manufacturing procedures. This tranquility of mind can cause enhanced performance and earnings in the future, as producers can operate with more self-confidence and stability. Overall, the benefits of LRP Insurance policy for livestock manufacturers are significant, using an important tool for handling threat and guaranteeing economic safety in an unforeseeable market environment.

Just How LRP Insurance Policy Mitigates Market Risks

Reducing market risks, Livestock Danger Security (LRP) Insurance coverage provides animals manufacturers with a trustworthy guard against rate volatility and monetary unpredictabilities. By supplying protection against unforeseen cost decreases, LRP Insurance coverage assists producers protect their investments and keep economic stability in the face of market go now variations. This kind of insurance policy permits animals manufacturers to secure a price for their pets at the beginning of the policy duration, making sure a minimum price level despite market modifications.

Actions to Safeguard Your Livestock Financial Investment With LRP

In the world of agricultural threat management, applying Livestock Risk Protection (LRP) Insurance entails a calculated procedure to protect investments against market changes and unpredictabilities. To secure your animals financial investment effectively with LRP, the first action is to assess the details dangers your operation faces, such as price volatility or unforeseen climate More Info events. Next, it is vital to study and choose a reliable insurance supplier that provides LRP plans customized to your livestock and business demands.

Long-Term Financial Protection With LRP Insurance Policy

Guaranteeing enduring monetary security with the usage of Livestock Danger Security (LRP) Insurance coverage is a prudent lasting technique for agricultural producers. By incorporating LRP Insurance policy into their risk monitoring strategies, farmers can secure their animals investments against unforeseen market changes and negative events that can endanger their financial wellness gradually.

One trick advantage of LRP Insurance for lasting financial safety is the satisfaction it uses. With a dependable insurance plan in location, farmers can mitigate the financial dangers linked with unpredictable market conditions and unexpected losses due to variables such as disease outbreaks or natural disasters - Bagley Risk Management. This security enables producers to concentrate on the everyday operations of their animals business without constant bother with potential financial problems

Additionally, LRP Insurance policy supplies a structured technique to managing risk over the long term. By establishing particular protection levels and choosing appropriate endorsement periods, farmers can tailor their insurance policy prepares to align with their economic goals and run the risk of resistance, guaranteeing a sustainable and secure future for their animals operations. Finally, purchasing LRP Insurance is a positive strategy for agricultural manufacturers to accomplish long lasting monetary protection and safeguard their source of incomes.

Conclusion

In final thought, Animals Risk Security (LRP) Insurance is a useful tool for animals producers to reduce market risks and secure their investments. It is a smart choice for protecting animals investments.